COP 28 Outcomes: Expert Insights from FORLIANCE’s Astrid Manciu

December 20, 2023

Expert Interviews

In the ongoing battle against climate change, the Conference of the Parties (COP) serves as a critical forum for global dialogue and decision-making. At COP 28, the spotlight was on the collaborative efforts required to tackle environmental challenges, a space where FORLIANCE, renowned for its expertise in forestry, climate, and sustainability, made its mark. Astrid Manciu, our expert in Markets, Policy & Guidance, represented FORLIANCE alongside our Managing Director Dirk Walterspacher, highlighting our dedication to crafting impactful climate strategies.

COP’s relevance has been underscored since the Paris Agreement, particularly regarding the formulation of international climate collaboration. Key to these discussions is Article 6, pivotal for entities involved in voluntary carbon markets (VCM). This article, especially sections 6.2 and 6.4, sets the parameters for international cooperation in achieving emission reduction targets, known as nationally determined contributions (NDCs). These sections are critical for organizations like FORLIANCE, guiding our approach to emission reductions and sustainable development.

At FORLIANCE, we develop comprehensive, and effective contributions to climate protection, biodiversity, and human well-being. Our presence at COP 28 was to engage in these essential conversations, aligning with our mission to guide partners towards their net zero carbon goals and to provide avenues for offsetting unavoidable emissions through nature-based projects. This exclusive interview with Astrid Manciu delves into the nuances of climate policy and market dynamics.

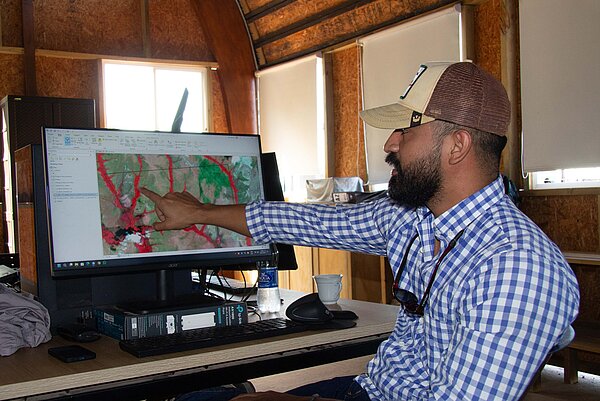

FORLIANCE CEO Dirk Walterspacher and our Expert Markets, Policy & Guidance, Astrid Manciu, took part at the COP 28 in Dubai. Astrid Manciu shares the insights on the conference.

Give us a brief overview of the key outcomes of COP 28, particularly in relation to the voluntary carbon market and nature–based offsetting projects?

Astrid Manciu: At COP 28, there weren’t any significant new agreements specifically impacting the voluntary carbon market (VCM). Players in this market closely watch Article 6 of the Paris Agreement during COP meetings. This article, especially its sections 6.2 and 6.4, outlines essential guidelines for voluntary cooperation among countries to meet their emission reduction targets, known as nationally determined contributions (NDCs). Although these don’t directly govern the VCM, they are influential in shaping its future direction and potential regulations.

It is expected, that Article 6, compliance and voluntary markets will merge more in future, we see first signs already. Independent crediting standards like Verra and Gold Standard are aligning their operations with the Paris Agreement’s objectives.

The most anticipated item on the agenda was the inaugural Global Stock Take, which for the first time addressed the reduction of fossil fuel use. While the final agreement was more moderate, advocating for a „phasing down“ of fossil fuels rather than a complete phase-out, it did acknowledge the crucial role of nature-based solutions and ecosystem restoration in both mitigation and adaptation efforts. The final text also underscored the importance of market mechanisms in achieving the goal of limiting global warming to 1.5°C and the commitment to reach net zero emissions by 2050.

In what ways do you foresee the decisions made at COP 28 influencing the voluntary carbon market (VCM)?

Astrid Manciu: The outcomes of COP 28 didn’t directly result in operational changes for Article 6.2 and 6.4, leaving the voluntary carbon market (VCM) largely unaffected in the immediate term.

While Article 6.2 is operational also without further text, Article 6.4, the UN-led crediting mechanism that will replace the Clean Development Mechanism, once operational, cannot start its activities. This void might be an opportunity for the VCM to step in, knowing that e.g. airlines will have to buy correspondingly adjusted credits in its first phase starting next year under the CORSIA framework.

Nevertheless, the voluntary carbon market was given a lot of attention, be it with the dedicated thematic VCM day or at the High-Level Roundtable on Unlocking High-Integrity Carbon Markets that was convened by the COP28 presidency. In the latter, the possibility and need of a co-existence of carbon pricing schemes, compliance markets and high integrity voluntary carbon markets (VCMs) was underlined, noting that all three mechanisms can play a critical role in the global net-zero transition.

Towards the end of COP 28, a noteworthy announcement was the joint statement from seven EU member states, which provided recommendations for private sector organizations making claims using carbon credits from the VCM. This initiative from countries including Germany, France, and the Netherlands is a positive step towards encouraging private sector engagement with the VCM and promoting the use of high-integrity carbon credits, thus enhancing trust and reducing fears of greenwashing accusations. The emphasis is clear: we need diverse financing channels for mitigation activities.

In reflection of COP 28, how do you see nature-based solutions contributing to climate mitigation and adaptation?

Astrid Manciu: Nature-based solutions are fundamental to achieving the goals of the Paris Agreement. The recognition of their importance was evident in the Global Stock Take (GST) text at COP 28, where parties stressed the significance of conserving, protecting, and restoring nature and ecosystems. This includes efforts like halting and reversing deforestation and forest degradation by 2030 and conserving biodiversity. These actions are not just about carbon sequestration; they’re about creating resilient ecosystems that can withstand the impacts of climate change.

How did COP 28 address the collaboration among nations for protecting and restoring ecosystems?

Astrid Manciu: Although COP 28 didn’t lead to conclusive negotiations on Article 6, there’s flexibility under Article 6.2 for nations to collaborate on a variety of activities, including ecosystem protection and restoration. The draft text for Article 6.4, which remains a point of contention, does mention conservation enhancement activities and forest-related removals. However, consensus on these points is still pending, with the Supervisory Body expected to continue working on recommendations for adoption at the next COP in Baku, Azerbaijan. These discussions suggest a growing acknowledgment of the importance of collaborative efforts in ecosystem conservation and restoration at an international level.

What collaborations/initiatives were established or strengthened at COP 28 to support the VCM? How effective do you think these initiatives will be?

Astrid Manciu: COP 28 saw the announcement of several collaborations aimed at creating a high-integrity net-zero ecosystem. Notable initiatives include the cooperation among the Verified Carbon Market Initiative (VCMI), Science-Based Targets initiative (SBTi), Greenhouse Gas Protocol (GHG Protocol), and International Center for Voluntary Carbon Markets (ICVCM), along with the Carbon Disclosure Project (CDP) and We Mean Business, to establish a comprehensive integrity framework for decarbonization. Additionally, standard-setting bodies like the American Carbon Registry (ACR), the Alliance for Responsible Travel (ART), the Climate Action Reserve, the Global Carbon Council, the Gold Standard, and Verra’s Verified Carbon Standard (VCS) announced their commitment to align more closely and aid countries in achieving their Nationally Determined Contributions (NDCs). These collaborations are poised to enhance trust and credibility in the voluntary carbon market (VCM) and should motivate the private sector to participate actively. The effectiveness of these initiatives will largely depend on their implementation and the continued commitment of the involved parties.

How does COP 28 propose to encourage businesses and the private sector to invest in the VCM ?

Astrid Manciu: The failure to reach a consensus on Article 6 during COP 28 shouldn’t deter private sector involvement. Rather, the various announcements made reflect the vital role of markets and the necessity of including forests in climate solutions. Clarity for businesses in the VCM comes from a joint statement by seven EU countries, which outlines recommendations for private sector engagement. This statement, along with other initiatives discussed at COP 28, shows a willingness to cooperate and improve the VCM. The private sector, equipped with comprehensive guidance and clarity, should feel encouraged to develop robust emission reduction strategies. My expectation is that increased clarity will lead to more decisive action in the sector.

With the heightened scrutiny on carbon offsetting projects, what insights or solutions were presented to address these concerns?

Astrid Manciu: At or around COP, there are traditionally several announcements of improvements and innovations in the carbon offsetting sector. A notable development was the introduction of Verra’s new REDD+ Methodology, designed to minimize over-crediting risks by transitioning to jurisdictional baselines. This shift is expected to enhance the accuracy and reliability of carbon credit evaluations.

The Integrity Council for the Voluntary Carbon Market (IC-VCM) is also making strides, focusing on setting high standards for integrity and quality in the carbon market. They are working towards approving the first batch of credits that meet these high standards by Q1 2024, aiming to simplify the process for buyers to identify and invest in high-quality credits.

Additionally, there were announcements from various exchanges planning to introduce standard tradeable contracts featuring specific high-quality criteria. These contracts are anticipated to streamline the trading process and ensure the integrity of the credits being traded.

Moreover, the ongoing work on Article 6.4 of the Paris Agreement should not be overlooked. Its goal is to establish a credible international benchmark for carbon crediting that upholds environmental integrity. This effort is crucial for enhancing the overall credibility and effectiveness of carbon markets.

What advice would you give to businesses that are considering investing in the voluntary carbon market or nature-based projects for the first time?

Astrid Manciu: For businesses looking to invest in the VCM or nature-based projects, my advice is to start engaging now. Understand your own emissions, set clear reduction targets, and determine the type of climate claim you aim to make, whether it’s a compensation or contribution claim. This will guide your choice of projects. The VCM is continuously improving and has demonstrated its ability to finance mitigation activities while supporting sustainable development. Engage directly with project developers and be transparent about your strategies, goals and achievements towards your stakeholders. This proactive approach is essential in a rapidly evolving market.

Looking forward, what trends or developments do you predict in the voluntary carbon market, and how should businesses strategize to stay ahead?

Astrid Manciu: Looking ahead in the VCM, we anticipate a notable trend towards the integration of various markets. This means that projects certified under independent standards like Gold Standard could be utilized for both compliance and voluntary purposes, provided they meet the necessary requirements. Such a development will enable more diverse use of carbon credits.

Another significant shift will be in the characteristics of the carbon credits themselves. We expect credits to evolve beyond just representing a ton of carbon dioxide equivalent, incorporating multiple characteristics such as being correspondingly adjusted, CCP labeled, CORSIA eligible, or denoting reduction and removal. This complexity might initially challenge buyers in selecting credits best suited to their goals.

There’s likely to be increased clarity in how businesses can incorporate carbon credits into their corporate strategies, reducing the risk of greenwashing accusations. It’s becoming increasingly clear that businesses should focus first on reducing their own carbon footprint while also financing external mitigation efforts. Transparency in these strategies is essential.

For businesses, having a strategy to address climate impact is non-negotiable. It’s crucial to understand the evolving market dynamics and secure a supply of carbon credits at competitive prices. As we move towards 2024, I’m optimistic that the VCM will continue to grow, providing essential financing for innovative projects that benefit both people and the planet.

How can businesses effectively engage with stakeholders, including local communities and governments, in the context of the voluntary carbon market and nature-based projects?

Astrid Manciu: Effective engagement requires clear and honest communication. Businesses should interact directly with local communities involved in carbon credit projects to understand and address their needs and concerns. It’s also important to advocate with governments for policies that support private sector investment in these projects. This approach ensures that the projects are not just about carbon credits but also about real benefits to people and the environment.

Is your business taking climate action?

Let’s connect and kick-start your corporate climate strategy.