Understanding the Latest ESG Policy Changes: What You Need to Know

March 07, 2023

Climate Strategy & Policy

Environmental, Social, and Governance (ESG) criteria have become an increasingly critical aspect of investing and corporate decision-making. Over the past year, we have witnessed several significant changes in ESG policy frameworks. In this blog post, we’ll explore the latest ESG policy changes and what they mean for investors, companies, and the broader global community.

The EU Taxonomy Regulation

The EU Taxonomy Regulation came into effect in July 2022 and aims to establish a common framework for sustainable investments. The regulation sets out criteria for economic activities that contribute to climate change mitigation, adaptation, and biodiversity protection. It also establishes disclosure obligations for financial market participants and issuers on how their activities align with the taxonomy criteria.

The EU Sustainable Corporate Governance Regulation (SCGR)

The EU SCGR was proposed in April 2021 and was adopted in December 2022. The regulation aims to ensure that companies operating in the EU pursue long-term sustainable objectives and take into account the interests of stakeholders, including employees, customers, and the environment. The regulation requires companies to report on their ESG practices, including their approach to climate change and other sustainability issues.

The UK Streamlined Energy and Carbon Reporting (SECR)

The UK SECR came into effect in April 2019 and applies to large companies and Limited Liability Partnerships (LLPs). It requires these organizations to report on their energy use and carbon emissions. In November 2022, the UK government announced plans to extend SECR reporting requirements to include all large businesses in the country, regardless of their legal structure.

The Global Sustainability Standards Board (GSSB)

In December 2022, the International Financial Reporting Standards Foundation (IFRS) established the GSSB, which aims to develop global sustainability reporting standards. The board will build on existing standards, including the TCFD recommendations, and develop new standards on a range of sustainability issues. The GSSB is expected to start its work in early 2023.

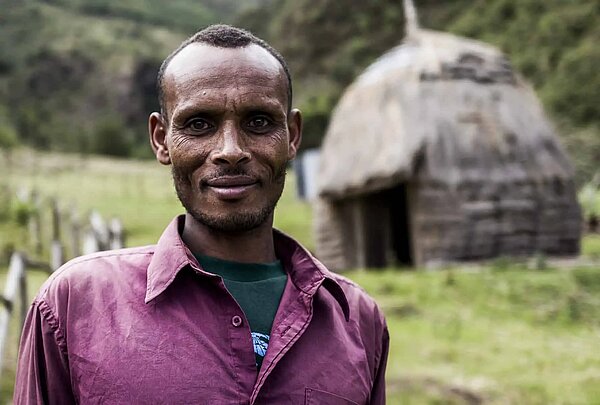

Investors, companies, and policymakers are recognizing that sustainable practices are essential for long-term economic stability and success.

These policy changes reflect the growing recognition of the significance of ESG factors in investment and corporate decision-making. Investors are increasingly aware of the risks and opportunities that ESG factors present and are calling for greater transparency and disclosure. Similarly, companies are realizing that ESG factors can impact their financial performance and reputational risk. As a result, companies are increasingly adopting ESG policies and disclosing their ESG practices.

The latest ESG policy changes demonstrate a growing focus on sustainability and ESG factors. Investors, companies, and policymakers are recognizing that sustainable practices are essential for long-term economic stability and success. By embracing ESG policies, companies can mitigate risks, capitalize on opportunities, and demonstrate their commitment to building a sustainable future. The new sustainability reporting regulations will play a crucial role in promoting greater transparency and comparability of sustainability performance, enabling investors and other stakeholders to make informed decisions.

Start you sustainability journey with FORLIANCE

We at FORLIANCE help you to get an overview and support you in reaching your sustainability goals. Let’s set up a call and get your climate action journey started.