The Compliance Shift: Why Smart Companies Turn to Nature-Based Credits

August 07, 2025

Climate Strategy & Policy

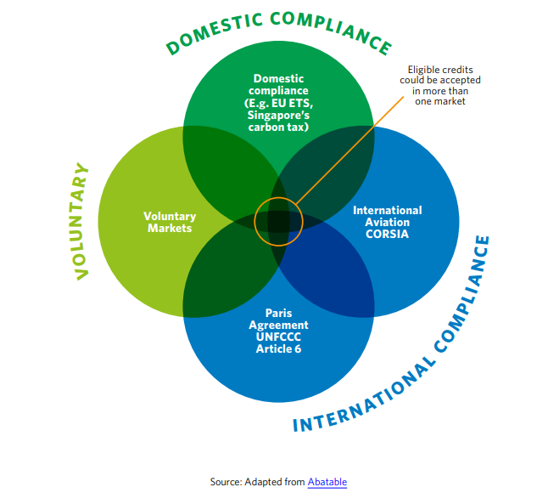

As net-zero targets tighten and carbon pricing mechanisms expand, companies are navigating a shifting compliance landscape. Instruments like carbon taxes and emissions trading systems (ETS) are driving demand for low-carbon transformation—and they also open doors to strategic flexibility.

International frameworks such as Article 6 of the Paris Agreement and CORSIA for aviation allow for using carbon credits in decarbonization strategies. These mechanisms aren't just helpful, they’re essential for achieving targets in a cost-effective, scalable way.

And as the supply of eligible credits remains limited, nature-based solutions (NBS) are stepping into a critical role: delivering real climate impact while helping corporates stay ahead of growing regulatory pressure.

Carbon Pricing 101: Taxes vs ETS and Where Credits Fit In

Carbon pricing instruments place a financial cost on greenhouse gas emissions, internalizing the environmental damage into economic decision-making. Policymakers use them as a market-based tool to encourage cost-effective abatement: companies and consumers will reduce emissions if it’s cheaper than paying the carbon price. As World Bank Senior Director Axel van Trotsenburg notes, carbon pricing “helps countries cut emissions, raise domestic revenues… and stimulate green growth and job creation” (carboncredits.com). In practice, carbon pricing takes two primary forms – carbon taxes and emissions trading systems (ETS) – both aiming to reduce emissions but through slightly different mechanics.

- Carbon Taxes: A government-set fee per ton of CO₂ (or equivalent) emitted. This directly prices emissions, giving emitters a clear cost for each ton. The market then determines the resulting emission reductions (the “cap”), as companies will cut emissions until the cost of abatement equals the tax. Taxes provide price certainty but not an explicit emissions quantity limit.

- Emissions Trading Systems (Cap-and-Trade): The government caps total emissions by issuing a limited number of allowances (each typically 1 ton CO₂). Companies must hold allowances for their emissions, and they can trade allowances in a market. This lets the market set the price of allowances based on supply and demand, while the cap ensures a specific emissions outcome. Well-known ETS examples include the EU Emissions Trading System and regional programs in North America and Asia.

Carbon credits enter the picture as a flexibility mechanism in both approaches. Credits (usually representing 1 ton of CO₂ reduced or removed) can be generated by projects outside capped sectors or in other countries, and purchased by emitters to meet obligations. This allows cheaper abatement opportunities elsewhere to be utilized, lowering overall costs. In effect, an emitter pays for reductions where they are most cost-effective – which is exactly the efficiency promise of carbon markets.

Carbon Pricing: Where We Stand—and Why It Matters for Corporates

By mid‑2025, 80 pricing schemes (43 taxes, 37 ETS) cover about 28% of global emissions, up from 24% last year—the fastest expansion on record (Weltbank DokumenteSustainability Mag). Yet this still leaves over 70% of emissions unpriced, particularly in emerging sectors and markets.

Simply put: businesses operating globally cannot rely solely on regulation to account for their emissions footprint. Internal carbon pricing and strategic use of carbon credits remain essential tools for managing climate risk and unlocking low‑carbon opportunities. Moreover, as compliance markets mature, they exert upward pressure on voluntary credit standards and prices—making early engagement beneficial.

Article 6 Explained: Cross‑Border Emission Trading

Domestic carbon pricing alone won’t get us to net zero. To cut emissions cost-effectively at a global scale, countries need tools to collaborate—and that’s where Article 6 of the Paris Agreement comes in. It allows countries, and in some cases companies with government approval, to trade carbon credits across borders and count them towards national climate goals (National Determined Contributions = NDCs). Done right, this can unlock finance, accelerate mitigation where it’s cheapest, and support sustainable development.

Article 6 is made up of two main mechanisms:

- Article 6.2 enables countries to sign bilateral or multilateral deals to trade “mitigation outcomes” (like tons of CO₂). The rules are flexible, but each country must transparently account for trades and apply a corresponding adjustment—an emissions bookkeeping method to prevent double counting.

- Article 6.4 introduces a UN-run crediting system, similar to the old CDM, where approved projects earn certified credits (A6.4ERs). These can be used by countries or companies, but if used toward another country’s target or a scheme like CORSIA, the host country must authorize the export and apply a corresponding adjustment.

This concept of corresponding adjustments is central to Article 6. It ensures that only one party claims a given reduction. Without this step, credits can still be used voluntarily—but not for official climate targets or regulated schemes.

In theory, Article 6 creates a global carbon market, channelling finance to the most cost-effective climate solutions. According to research, it could save billions annually while increasing overall climate ambition. But implementation is slow. Few countries have clear approval processes, and many remain cautious about authorizing credits they might need later for their own NDCs.

Still, momentum is clearly building. Switzerland is leading the way with over a dozen Article 6 agreements already signed, with countries like Ghana, Thailand, Senegal, and Peru. It is also the first country to complete an actual Internationally Transferred Mitigation Outcomes transaction (1,916 ITMOs from Thailand to Switzerland). Other early movers include Japan, with partnerships in 28 countries, as well as Sweden, Norway, and Singapore. These pioneers are laying the groundwork for a functioning international carbon market, turning Article 6 from theory into practice (Visualising Article 6 Implementation - IETA).

CORSIA: A Sign of What’s Coming

The aviation sector is the first to face mandatory offsetting under the global CORSIA framework, which requires airlines to compensate for emissions exceeding 85% of 2019 levels using eligible carbon credits.

While CORSIA applies specifically to aviation, it signals a broader trend: more sectors will likely face similar compliance requirements as countries work to meet their NDCs and activate Article 6 frameworks.

With stringent eligibility rules and rising prices, CORSIA highlights the growing need for high-quality, compliance-ready credits—something forward-looking companies are already factoring into their climate strategies.

Why Carbon Credits Matter for Business: A Strategic Asset

High-integrity carbon credits are no longer a “nice-to-have.” They’re an increasingly strategic tool especially as most sectors still operate outside formal compliance systems but will likely face regulation as climate policy tightens globally.

- Risk management: Credits complement internal decarbonization efforts and provide a buffer against tightening regulations and rising carbon prices

- Cost efficiency: In hard-to-abate sectors, nature-based credits can offer lower-cost mitigation compared to internal abatement.

- Market positioning: Early engagement—particularly in Article 6-aligned or CORSIA-eligible credits—signals climate credibility and ESG leadership.

- Co‑benefits: Carefully chosen NBS projects (e.g. mangrove restoration) can deliver measurable social and ecological impact while aligning with corporate responsibility and investor expectations.

As host countries scale up Article 6 implementation and authorization processes, the supply of eligible credits is expected to increase. However, for the aviation sector, competition and firm compliance deadlines may drive near-term scarcity and price increases. For corporates outside aviation, now is a smart time to engage with carbon markets, gaining experience and securing access before “voluntary” becomes “required.”

Nature Based Solutions: Strategic, Scalable, Compliance-Ready

Nature-based solutions (NBS) do more than remove carbon—they deliver measurable biodiversity, community, and reputational returns. But their real power lies in their strategic role within future carbon markets.

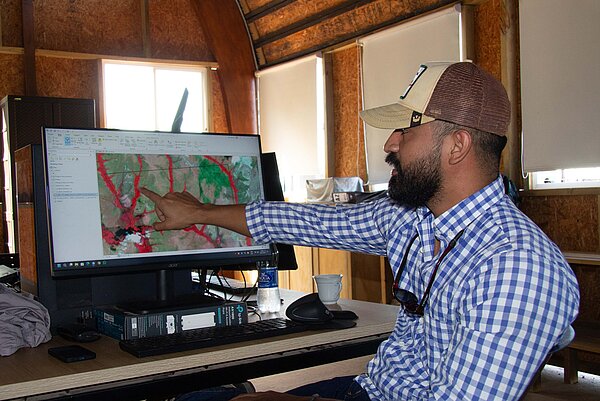

Projects like FORLIANCE’s XiCO₂e: Durango Forest Project in Mexico demonstrate how high-integrity NBS can be structured for alignment with international compliance pathways such as Article 6 and CORSIA. While many countries are still establishing approval systems to authorize credit exports, companies that engage early can help shape demand and unlock project financing.

Accessing these premium markets requires more than robust project design. Companies must understand:

- Host Country Authorization: Still missing in many nations, but essential for compliance-grade eligibility.

- Readiness Gaps: Registries, MRV systems, and approval bodies are in development—but not yet mature.

- Policy Risk: Governments may reserve credits for domestic targets, influencing availability for buyers abroad.

Even so, early offtake agreements and long-term partnerships can accelerate implementation, reduce investment risk, and secure access to high-quality, potentially compliance-eligible supply. For companies navigating future regulatory pressures, investing now—rather than reacting later—can lock in value and leadership.

Integrating Voluntary and Compliance: Building Long-Term Resilience

Despite the rise of compliance markets, around 72% of global emissions remain unpriced. For most companies, voluntary climate action remains the most immediate and flexible pathway.

A strategic approach for voluntary buyers today means:

- Following the mitigation hierarchy: Prioritize internal reductions, then compensate unavoidable emissions with high-quality carbon credits.

- Engaging early in project development: Supporting or contracting credits early helps secure supply, shape project impact, and build long-term value.

- Using recognized integrity frameworks for buyers: Initiatives like the VCMI Claims Code of Practice or IETA’s Guidelines for High-Integrity Use of Carbon Credits help ensure voluntary action meets growing stakeholder expectations.

This is not just climate responsibility—it’s risk management. Companies acting now on credible voluntary strategies can reduce long-term exposure to policy shifts, rising credit prices, and supply scarcity as regulation catches up.

FORLIANCE’s Role: A Strategic Partner for Forward-Thinking Buyers

FORLIANCE bridges voluntary and emerging compliance markets by:

- Developing high-integrity NBS projects, from reforestation to mangrove restoration, designed to meet the highest environmental and social standards.

- Staying connected to the pulse of policy developments—through active participation in working groups and partnerships with global market stakeholders (e.g. IETA)—to ensure our clients benefit from the latest market insights.

- Advising buyers navigating carbon credit strategies, helping align procurement with evolving frameworks like Article 6 or CORSIA, without losing sight of credibility and long-term value.

- Committed to future-ready supply, with a strong pipeline of projects designed to deliver voluntary impact today—and compliance potential tomorrow.

Our focus: Making carbon credit procurement less risky, more transparent, and strategically aligned with your business needs.

Final Takeaway: Time Is Now—Don’t Wait to Engage

For airlines and other CORSIA-covered companies, timelines are clear and inflexible. With limited compliant supply projected in the near term, early engagement is critical to secure access and manage cost exposure.

For corporates in the voluntary space, the path is equally urgent. Early offtake agreements help de-risk project financing, signal demand, and secure access to high-quality credits—while reinforcing a company’s climate leadership.

Nature-based solutions remain one of the most compelling tools available:

- Cost-effective mitigation with high integrity

- Real-world co-benefits for people and ecosystems

- Flexible use across voluntary and emerging compliance frameworks

If your company is exploring climate action pathways—be it carbon pricing, voluntary compensation, or compliance-aligned sourcing—this is the moment to act. FORLIANCE can help you move from intention to impact, with credibility and strategy in sync.